Built on Real Data

Reliable data from a nationwide physical device network, enhanced by broad mobile coverage. No modeling assumptions. No opaque sourcing.

Turn Real-World Activity Into Actionable Market Signals

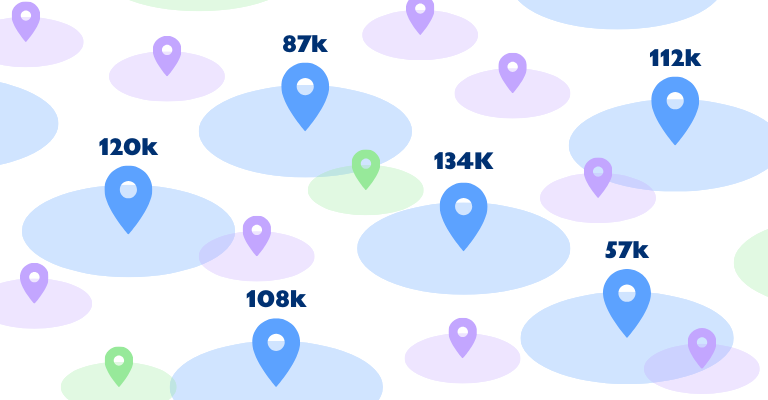

Incorporate high-fidelity location and movement data into investment strategies to identify trends, anticipate shifts, and validate market hypotheses ahead of traditional indicators.

Use verified, real-world behavioral data as an alternative signal to enhance forecasting models, improve trade timing, and reduce information lag.

Leverage foot traffic, visitation patterns, and mobility trends as non-traditional data inputs to anticipate revenue performance, sector momentum, and consumer demand.

Incorporate high-frequency, real-world data to validate assumptions, reduce noise, and enhance predictive models across equities, commodities, and macro strategies.

Measure the real-time effect of product launches, earnings announcements, policy changes, or disruptions by observing immediate changes in physical-world activity.

Access historical and longitudinal datasets to test strategies, validate correlations, and train AI models across different market conditions and time frames.

Reliable data from a nationwide physical device network, enhanced by broad mobile coverage. No modeling assumptions. No opaque sourcing.

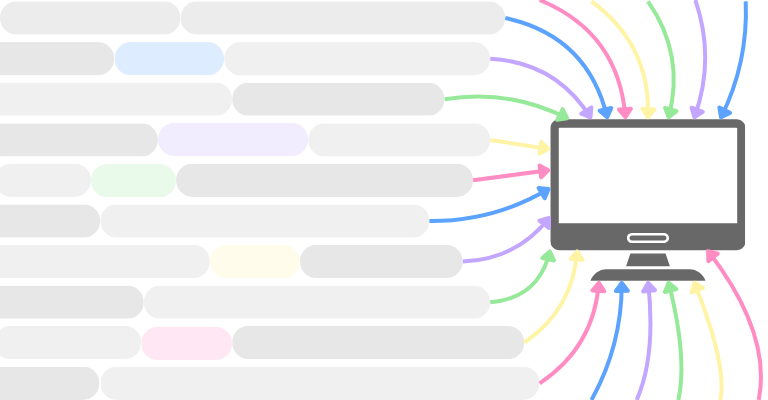

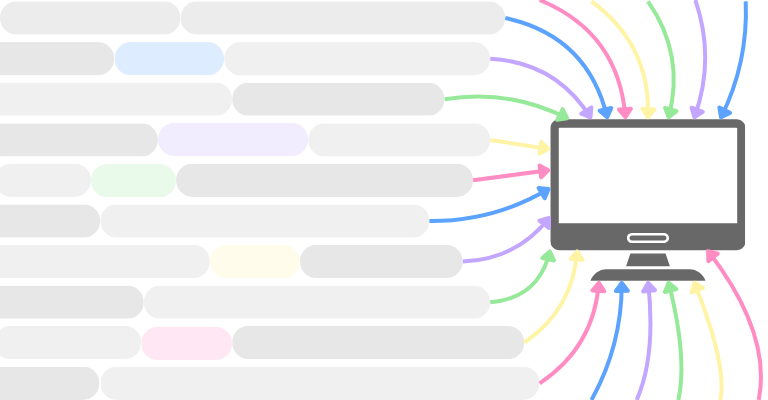

Clear, decision-ready insights without the need for analysts, custom queries, or technical overhead.

Our AI model turns complex data into clear visual insights while generating AI-ready prompts for customized analysis using external AI tools.